Silver Surge: India’s Record-Breaking Imports and What It Means for Global Markets

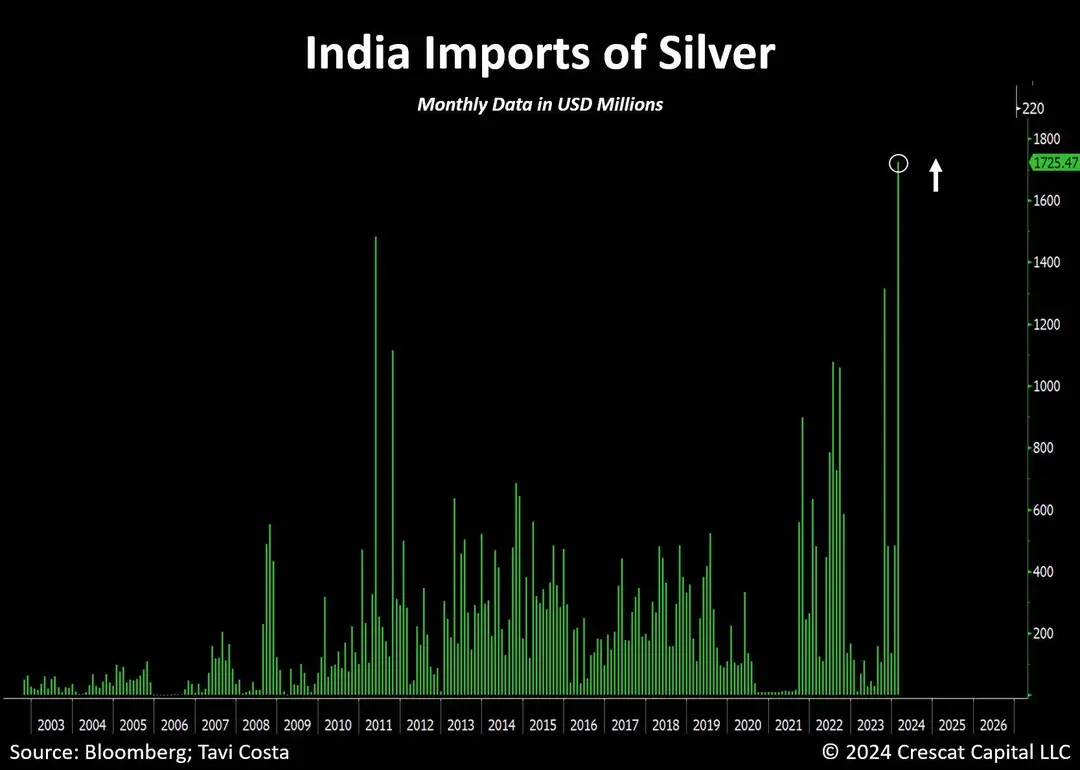

In February, India witnessed an astounding 260% surge in silver imports, reaching an all-time high. The driving force behind this remarkable increase was the reduction in import duties, which incentivized substantial purchases from the United Arab Emirates (UAE). As we delve into the details, let’s explore the implications for both India and the global silver market.

1. The Surge and Its Impact

* Record-Breaking Imports: India imported an impressive 2,295 metric tons of silver in February, a significant leap from the 637 tons recorded in January. This surge reflects the growing appetite for silver within the country.

* UAE Trade Dynamics: Traders capitalized on the favorable duty structure, importing a whopping 939 tons from the UAE. The lower duty acted as a catalyst, encouraging large volumes of silver to flow into India.

2. India: A Key Player in the Silver Market

* World’s Largest Silver Consumer: India holds the distinction of being the world’s largest consumer of silver. The surge in imports underscores its pivotal role in shaping global silver prices.

* Price Support: With higher demand within India, global silver prices are poised to remain buoyant. Investors and traders should closely monitor this trend, as it may impact their portfolios.

3. 2024 Outlook and Industry Insights

* Robust First Two Months: In the initial months of 2024, India’s silver imports reached 2,932 tons, surpassing the entire 2023 figure of 3,625 tons. This surge, however, led to an unexpected consequence.

* Indian Prices at a Discount: The influx of silver caused Indian prices to dip, resulting in a discount. Banks responded by nearly halting imports in March to manage the situation.

* Cyclical Nature of Imports: Chirag Thakkar, CEO of Amrapali Group Gujarat, sheds light on the cyclical nature of Indian imports. After a record-buying spree in 2022, the subsequent dip in 2023 was anticipated. Now, as we enter 2024, expectations are high for a rebound in silver imports.

* Solar and Fabrication Demand: The silver industry anticipates a surge in demand driven by the fabrication and solar sectors. As these industries expand, silver’s role as a versatile and valuable metal becomes even more pronounced.

4. Investment Perspective

* Silver vs. Gold: Investors are increasingly turning to silver as an investment asset. The belief that silver will yield higher returns than gold has fueled interest in this precious metal.

In summary, India’s silver imports have set a new benchmark, and the industry eagerly awaits further developments. As we navigate 2024, keep an eye on the silver market—it’s a dynamic landscape with potential for growth and opportunity.

Note: The original blog post was sourced from Reuters and has been restructured and enhanced for clarity and relevance

(source: https://uk.finance.yahoo.com/news/indias-february-silver-imports-hit-205148910.html)

Disclaimer: General Information Regarding Precious MetalsThe information provided in this document or any related internet link (collectively referred to as the “Document”) is of a general nature and is intended solely for informational purposes. It does not constitute personalized advice, nor does it influence any individual’s decision-making process concerning precious metals or related products. Please carefully consider the following points:General Advice Only: Any advice contained in this Document is of a general nature. It has been prepared without considering your specific objectives, financial situation, or personal needs (referred to as “Personal Circumstances”). Before acting on any general advice, we strongly recommend seeking professional advice tailored to your Personal Circumstances.Acquisition Decisions: If the advice pertains to the acquisition or potential acquisition of any precious metal or related product, it is crucial to seek independent professional advice before making any decisions. Assess the appropriateness of such advice based on your unique situation.Accuracy and Reliability: While the information and opinions in this document are based on sources we believe to be reliable, Bullion Store and its associated entities do not expressly or implicitly warrant, represent, or guarantee the accuracy, completeness, reliability, or currency of the information. The content is subject to change without notice, and we are not obligated to provide updates.Past Performance Disclaimer: Past performance should not be relied upon as an indicator of future performance. Market conditions can fluctuate, and historical data may not predict future outcomes.Independent Verification: If you intend to rely on the information provided, we recommend independently verifying its accuracy and completeness. Seek professional advice regarding its suitability for your Personal Circumstances.Liability Limitation: To the extent permitted by law, Bullion Store , its associated entities, and their officers, employees, and agents accept no liability for any loss or damage arising from the use or reliance on the information in this Document.Confidentiality and Reproduction: This Document is intended for the exclusive use of Bullion Store clients and may not be distributed or reproduced without consent.Remember that individual circumstances vary, and professional advice tailored to your specific situation is essential. Always exercise due diligence and consult experts when making financial decisions related to precious metals.